Let’s be real, money can be overwhelming, period. Add to that a society built on consumerism, aesthetics, and status (Instagram can literally target you based on your conversations) and you have a recipe for anxiety. It seems like we’re all working harder and harder just to live and to be honest, financial independence can seem like a pipe dream to many of us. While getting there isn’t always easy, it is possible.

Building wealth and getting clarity around your finances doesn’t have to be daunting or stressful. In fact, with the right practices instilled, it can be wholly liberating.

Let me back up for a second. A few months ago, I started working with a financial advisor to get my books in order, evaluate the profitability of my business, and progress my financial health. I’m not going to lie, it has been extremely difficult to balance accounts and practice new habits. However, seeing the shifts has been motivating and even empowering, and I know I’m setting up my future self for a better life.

Excited at my personal progress, I decided to hop on a call with Allegra Moet Brantly, the founder of Factora Wealth—a women’s wealth movement that is educating and empowering women to attain financial freedom— to talk about all things finance. I was blown away by her ability to make it sound fun and even sexy. Brantly’s approach is digestible. With her passion, I have no doubt she’ll fulfill her altruistic mission: 1 million women to $1 million in net worth.

If you want to be one of them, then read on to educate yourself about debt, value-based spending, the best saving habits, financial freedom, and the key components that lead to financial success. It won’t be easy to implement these new habits, but you certainly won’t regret it.

Allegra Brantly, Founder of Factora Wealth; Image by Riley Blanks

Pay Off Your Credit Card Debt

The average American household has an average of $13,000 of credit card debt. And that is the worst kind of debt. But not all debt is bad. “Debt with a plan can actually be really good for acquiring assets,” assures Brantly. “When we talk about ‘bad debt’, we are talking about consumer debt. And the reason it is so bad is because of the three little letters: A. P. R. Annual Percentage Rate is the amount of money you are paying for borrowing money, to begin with. Let’s say your APR is 20%. That means every time you spend $100 on that credit card and can’t pay it off, that $100 item was actually $120.”

Brantly’s recommendation is to educate yourself about finance and further, to become more aware of your status. She jokes that your credit score is like your adult GPA. “Pull off the bandaid and become aware of your APR rates, your credit score (which you can get for free) and make a plan to pay it off,” she says. One of the methods Brantly recommends is the Snowball Method where you focus on paying off the debt with the highest APR or the highest balance first.

Determine Your Priorities

When you prioritize debt, think about high interest versus low interest. Mortgage rates, for example, can have an interest rate as low as 3%, making them less pressing. Whereas, credit cards with high APR rates need to be aggressively paid off.

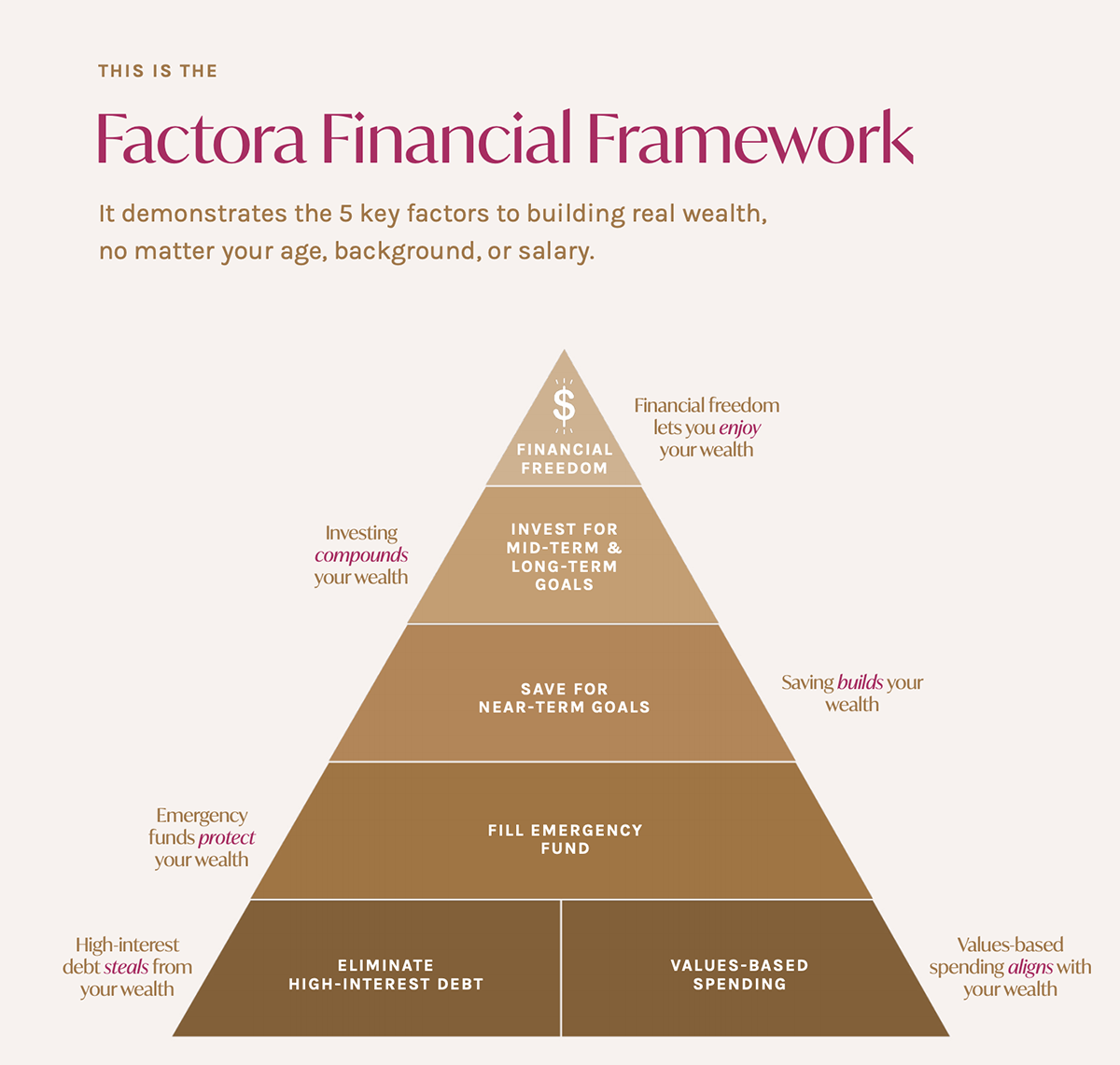

Paying off debt and building an emergency fund need to work in tandem. If you don’t have that backup savings account, then you may find yourself on a slippery slope back into debt if something unexpected happens. Brantly says there are five key factors to building real wealth, no matter your age, background, or salary. “It’s kind of like Maslow’s hierarchy of needs,” she explains. “By looking at the chart, you may find that one of your values is not being stressed. Being in debt is stressful so you will feel more compelled to rid yourself of that burden.”

Brantly stresses that high-interest debt steals from your wealth; values-based spending helps you get in alignment with building wealth, and an emergency fund protects your wealth so that you don’t slide back into high-interest debt.

Practice Value-Based Spending

The first step is awareness: know what you’re spending. “Look back at the last three to six months of spending and analyze how much you’re spending on your lifestyle,” she advises. “We often assume that we’re just paying for rent and food but our brains want to rationalize that we’re on our best behavior, so it doesn’t allow us to think about all of the subscription boxes.”

Value-based spending is a lot easier than budgeting. Setting a budget can feel restrictive, like being on a diet. “We’re good for a week and then we see a pair of perfect, white sneakers that Instagram keeps targeting us for,” says Brantly. “But that instant gratification won’t be gratifying for long because it’s not aligned with our values.” Once you determine three values that really matter to you, you’ll find that they can function as a filter. An example would be equity, family, and leverage (when you’re willing to spend money on things that help make life easier). Buying the shoes doesn’t align with any of those pillars, so it needs to be a preplanned choice.

Open a High-Yield Savings Account

Saving is the inverse of spending. Brantly uses something called Parkinson’s law to explain why we fall into the habit of over-spending. “Parkinson’s law states that work expands to fill the time available for its completion. Basically, any one thing can shrink or contract to the size of its container. In relation to money in a bank account, the reason you end up spending what you should be saving is that it’s right there, visible, in your checking account.” Brantly encourages opening a high-yield savings account and automating transfers on a monthly basis. That recurring act will give you accessibility to only what you should be spending.

Brantly urges individuals not to use a regular savings account. The average interest rate on a bank savings account is about 0.1%. That means if you have $10,000 of your emergency fund sitting in bank savings, you’re making a dollar. If you move that money to a high-yield savings account, you’ll make a much better profit.

Understand the Definition of Financial Freedom

According to Brantly and her model, financial freedom is an equation: enough passive income to outpace your expenses. When you have financial freedom in your life, work becomes an option instead of an obligation. Brantly is not vying for young people who are financially free to stop working either, she is simply saying that having that choice can liberate financial stress and even lead to more contentment in your career.

“Financial freedom allows you to enjoy your wealth because time is no longer a finite resource,” she says. “I explain to women that when they go to work, even as an entrepreneur, they are trading time for money. But, if you can buy assets to create additional income, then you are trading money for assets that bring you more money.”

If you get on this train and educate yourself, you will find that you don’t always have to rely on yourself and your body to make money. It takes a lot of time, effort, and sacrifice to get up every morning and go to work. Brantly goes on, “We all want more time to enjoy our lives, not just work for a living.”

Instill the Key Components That Lead to Financial Success

Brantly says there are six qualities that every wealthy woman should try to encompass:

- Planning: Determine your financial goals, write them down, and find an accountability partner. You can’t get what you want if you don’t plan for it. When it comes to money, you have to be goal-oriented.

- Frugality or Intentionality: Commit to saving more, spending less, and sticking to a plan. This formula leads to an ability to have a passive income because if you spend all of your money then there will be nothing left to invest it.

- Confidence: In order to gain financial confidence in managing your money and investing, you need financial education. We didn’t learn this in school. You have to go and find it, otherwise, you will stay in a state of stress. Inaction is terrible for your finances.

- Responsibility: Accept your role in financial outcomes and take action to make financial changes in your life.

- Focus: See your process through to completion one step at a time. Accountability is crucial.

- Social indifference: Don’t succumb to buying the latest thing as a means of feeling good. If you practice this, it will change your life. Women are the targets of consumerism. But, if you appreciate how you look and how you are inherent, you will save yourself a lot of time, money, and energy.